imagePRO Market Pulse Series: CT purchase in 2025

Share this article:

The imagePro Market Pulse (iPMP) is a series of insights on the US radiology market provided by The MarkeTech Group.

The iPMP is a custom research initiative with our imagePRO™ panel of over 350 USA hospital-based imaging directors and managers. In this second series, we asked the imagePRO panel to share their plans for their next MRI purchase, their available budget, the vendor they are most likely to select, and the important factors in selecting an MRI vendor. All questions were single-select.

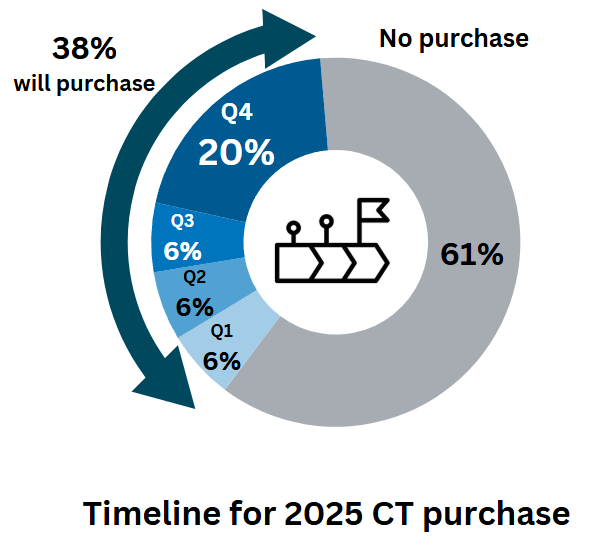

Next CT purchase timeline

38% of the imagePRO panel members expect to purchase a CT in 2025. Most of these planned acquisitions will occur in Q4 of 2025, with 20% of imagePRO members completing their product selection during this quarter. An additional 18% of imagePRO members will finalize their CT deals evenly throughout Q1, Q2, and Q3, with each quarter accounting for 6%.

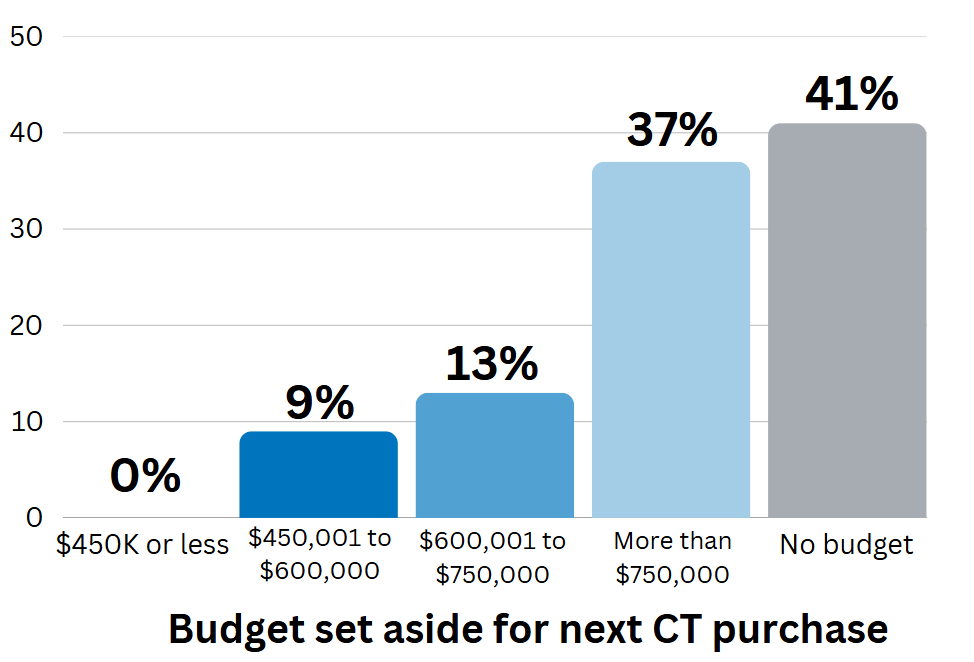

Budget available for next CT purchase

While 41% have yet to define their budget, 37% have set a budget of $750k or higher for their next CT purchase – which is likely to be a high-end system. 13% have a budget between $600k and $750k, and 9% between $450k and $600k – for the purchase of a mid-range CT scanner.

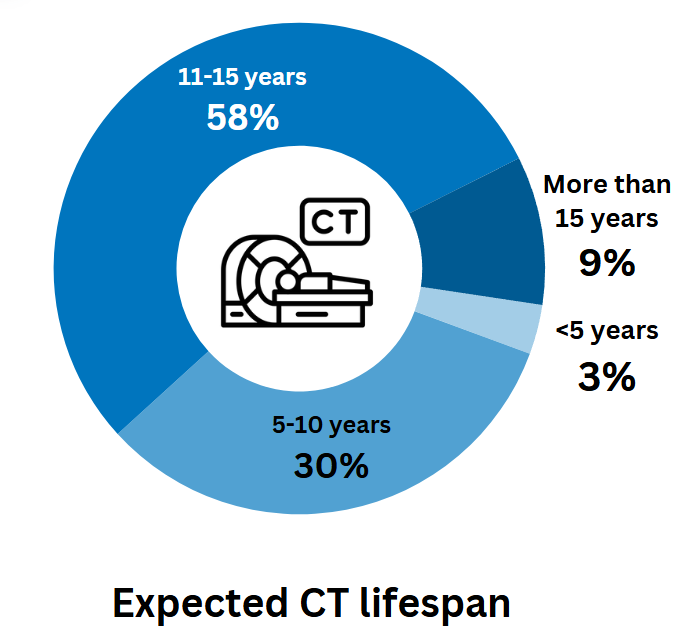

Expected CT lifespan

In 2014, the European Society of Radiology described the CT scanner life expectancy based on utilization: 8 years for high (24 h/day 5 days/week or 750 8-h shifts/year), 10 years for medium (16 h/day 5 days/week or 500 8-h shifts/year), and 12 years for low (8 h/day 5 days/week or 250 8-h shifts/year).

In 2025, the majority of the imagePRO panel (58%) expects their next CT scanner to last between 11 and 15 years. Since average utilization rates have steadily increased because of higher patient volumes, it is likely that the trend is shifting toward extending the lifespan of CT scanners for “medium” and “high” utilization rates. 33% expect their CT system to last 10 years or less. For the 9% foreseeing a CT lifespan of 16 years or more, service, maintenance, and upgrade offerings will be crucial to handle usage over such extended periods.

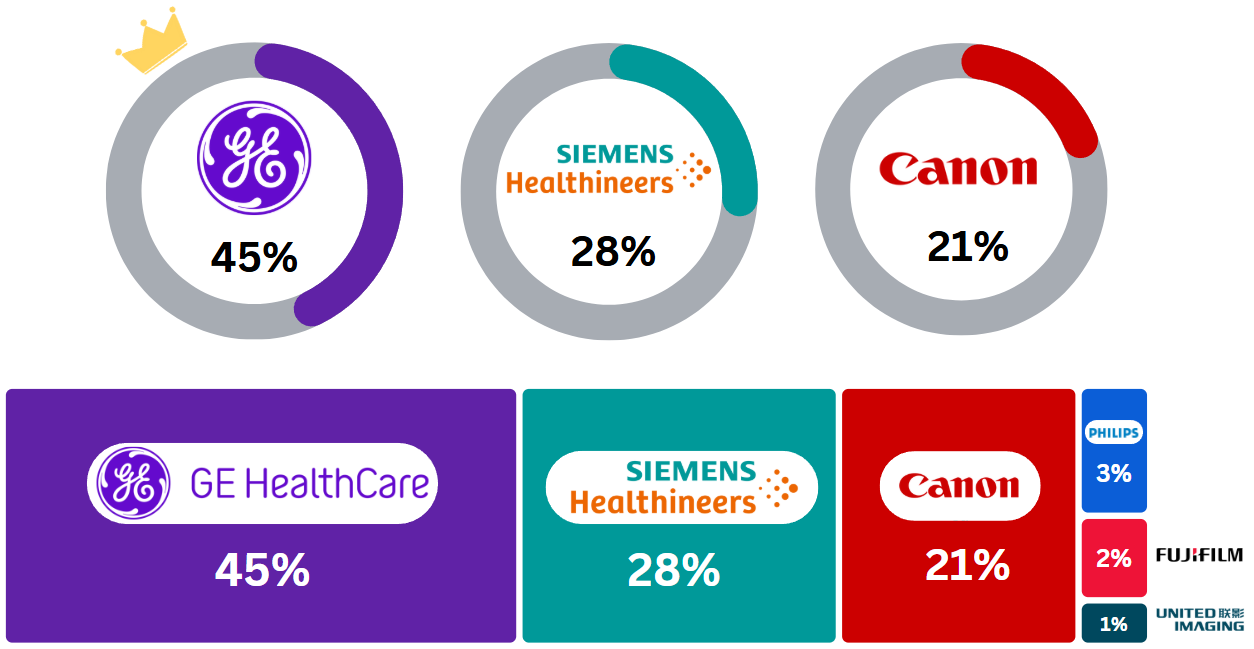

Most Likely Vendor for next CT purchase

45% of imagePRO members identify GE Healthcare as their most likely choice for their next CT purchase, making GE Healthcare the top vendor. Siemens Healthineers (28%) and Canon (21%) round out the top 3. Only 6% of imagePRO members are considering other vendors, including Philips (3%), FujiFilm (2%), and United Imaging (1%). No members indicated they would select a vendor outside of this list of major OEMs.

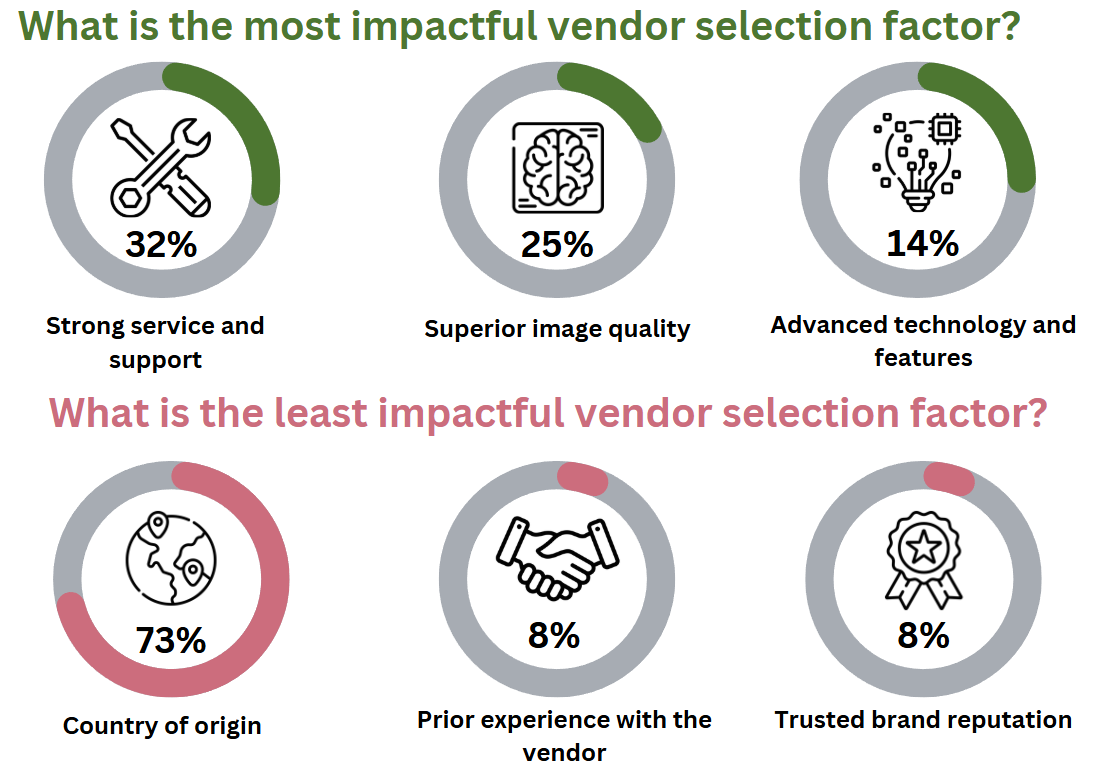

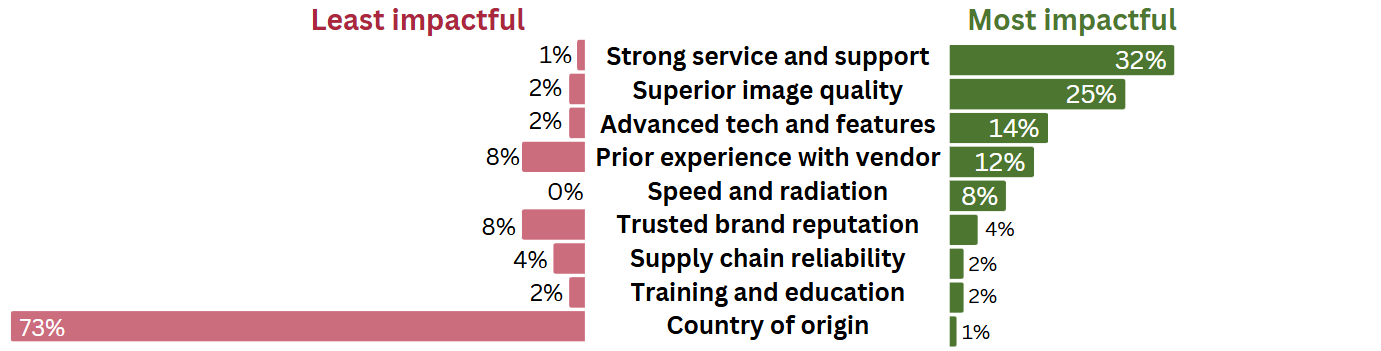

Factors for selecting a CT vendor

Aside from price, strong service and support (32%), and superior image quality (25%) are the most impactful factors when selecting a CT vendor. Service and support is crucial for high-utilization CT systems over an extended lifespan. Advanced technologies and features (29%) come third among most impactful factors. Prior experience with a vendor is most impactful for 12% of imagePRO members but also least impactful for 8%. This duality shows that while some customers select their current CT vendor for their next purchase, others are open to considering new vendors, especially since trusted brand reputation is least impactful for another 8%. The country of origin is considered the least impactful factor for CT vendor selection by 73%.

Do not hesitate to contact us for deeper analysis on this iPMP series – the imagePRO panel can be segmented by 49 different variables including hospital type, current install base, and many other demographic factors!