imagePRO Market Pulse Series: First Results

Share this article:

The imagePro Market Pulse (iPMP) is a new series of insights on the US radiology market provided by The MarkeTech Group.

The iPMP is a custom research with our imagePRO™ panel of over 350 USA hospital-based imaging directors and managers. In this first series, we asked the imagePRO panel to tell us who is the best vendor for MR, CT, and ultrasound equipment. We also asked which vendor is the most innovative overall and with which one they are most likely to partner in 2025 for large modalities (CT and MR) and for ultrasound equipment. All questions were single-select.

Capital equipment and IT purchases are always a challenge, with hospitals and health systems looking to modernize and improve patient care. With current high-cost financing options such as bank loans, retained earnings, and grants, organizations must strategically align investments with their clinical and operational goals to ensure sustainability.

Best-in-Class Vendor

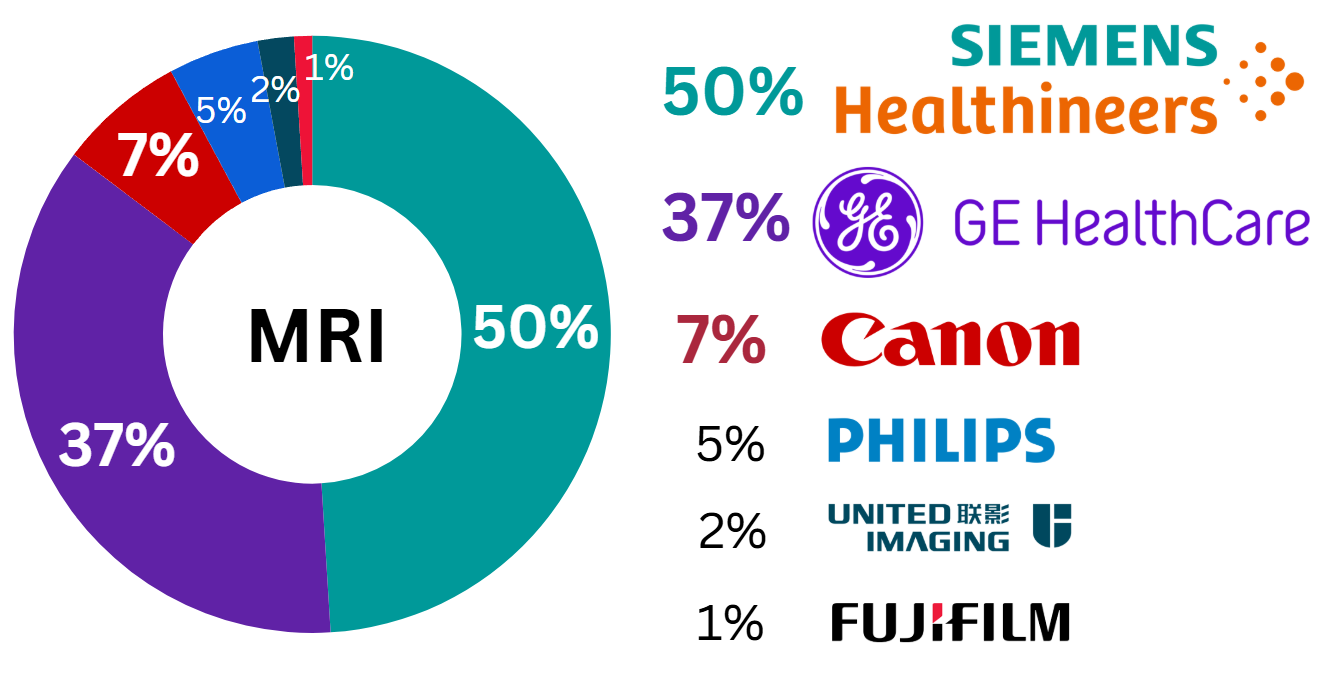

For MR, Siemens Healthineers is the clear top 1 vendor: 50% of imagePRO members selects Siemens Healthineers as the company commercializing the best MRI products (quality, reliability, and performance) regardless of price.

GE Healthcare is a strong second vendor with 37% while other vendors are all selected by 7% or less (7% for Canon, 5% for Philips, 2% for United Imaging, and 1% for FujiFilm)

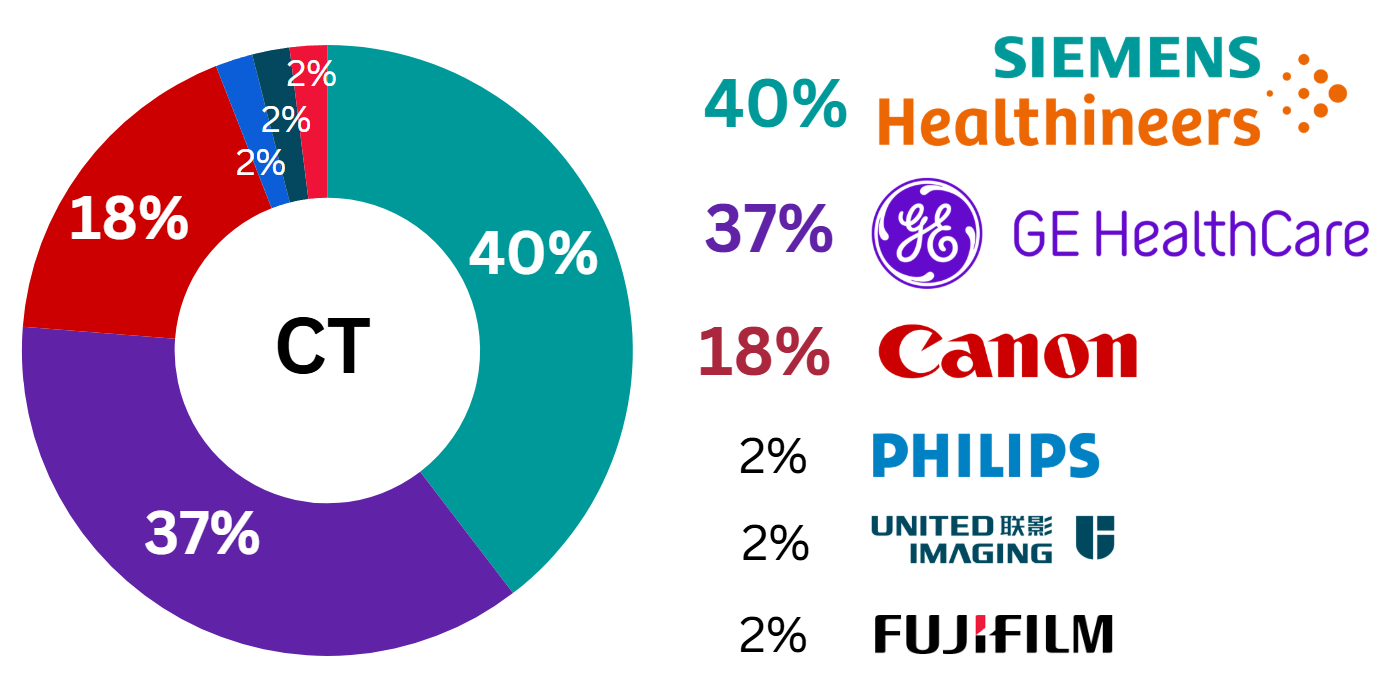

For CT, Siemens Healthineers (40%) and GE Healthcare (37%) are the 2 vendors most selected as offering the best CT products. Canon is third with 18% and other vendors are behind with 2% (Philips, United Imaging, and FujiFilm).

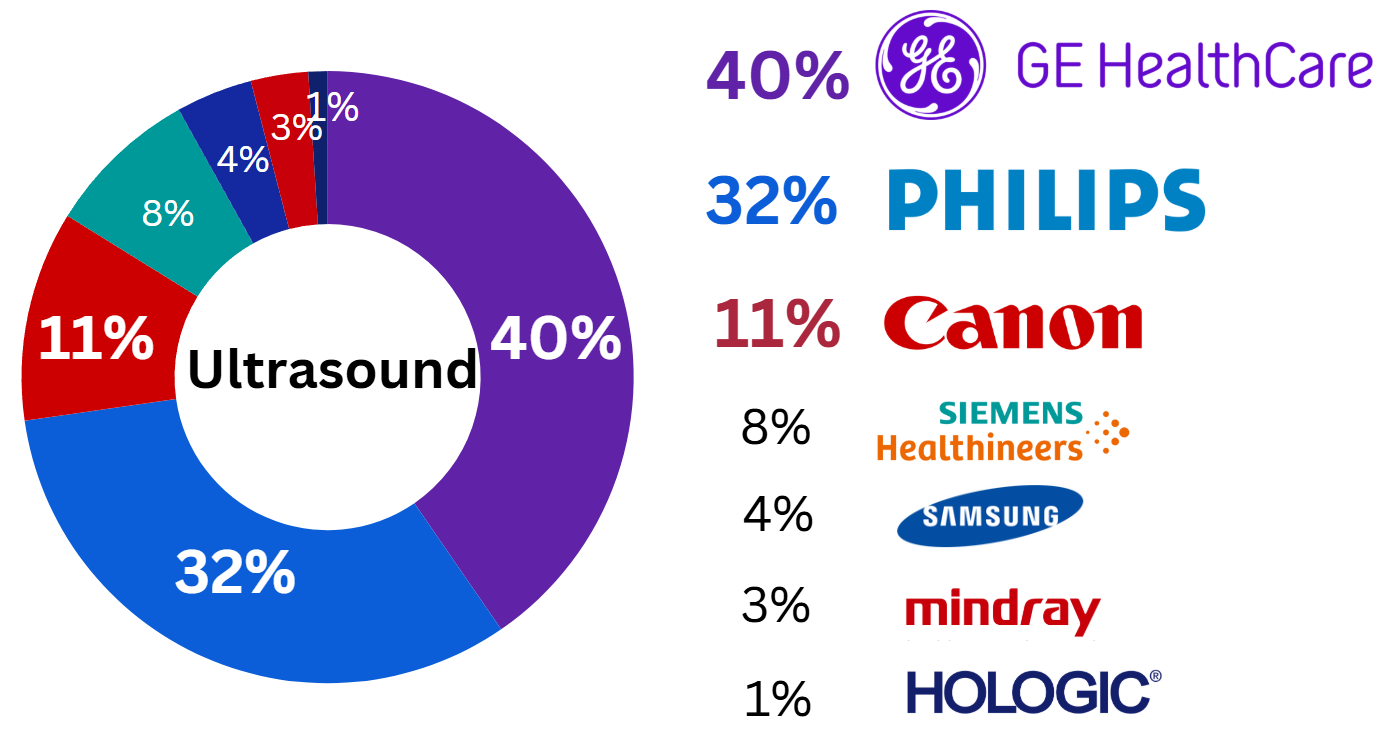

For Ultrasound, the company commercializing the best ultrasound systems is GE Healthcare, selected by 40% of imagePRO members. Philips is second (32%) and Canon third (11%). Siemens Healthineers is selected by 7%, Samsung by 5%, Mindray by 4%, and Hologic by 1%.

Most Likely Partner for 2025

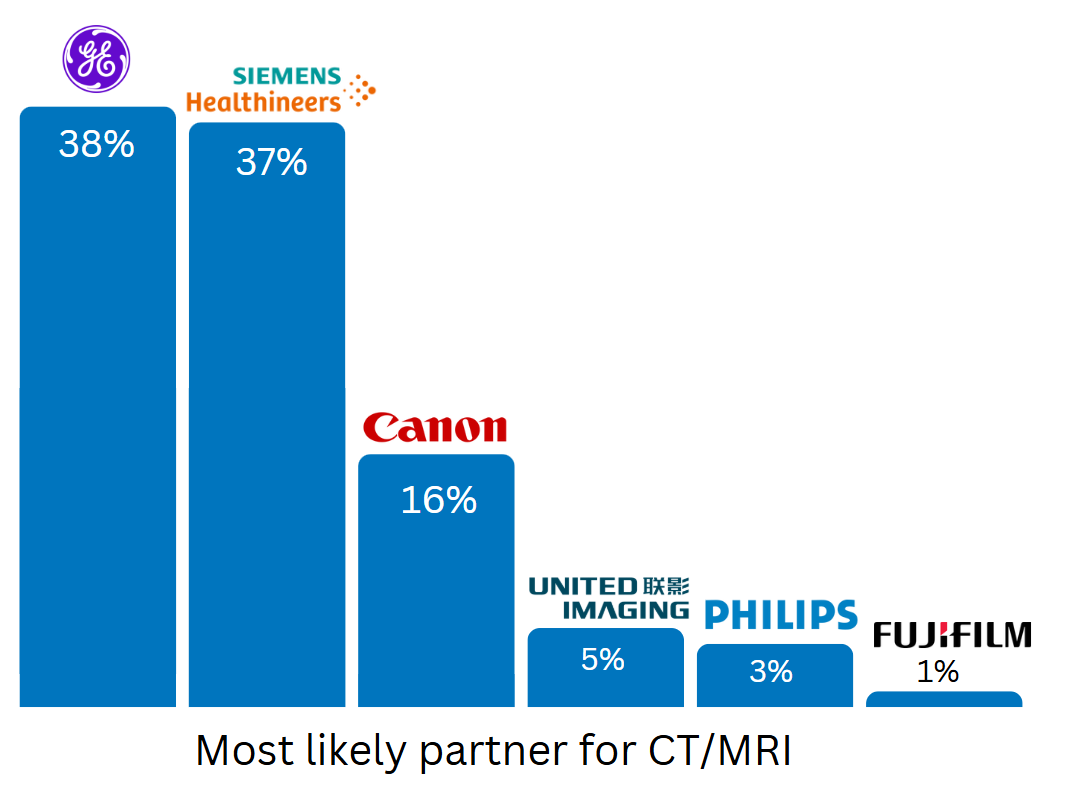

For the most likely partner for 2025, it is no surprise to find the top 3 vendors of MR and CT all together. GE Healthcare and Siemens Healthineers are most likely to be selected as vendor for CT and MR equipment in 2025 with 38% and 37% respectively. Canon is selected by 16 as most likely partner for large medical imaging equipment for 2025. The three other players (United Imaging, Philips, FujiFilm) are within the margin of error with less than 5%.

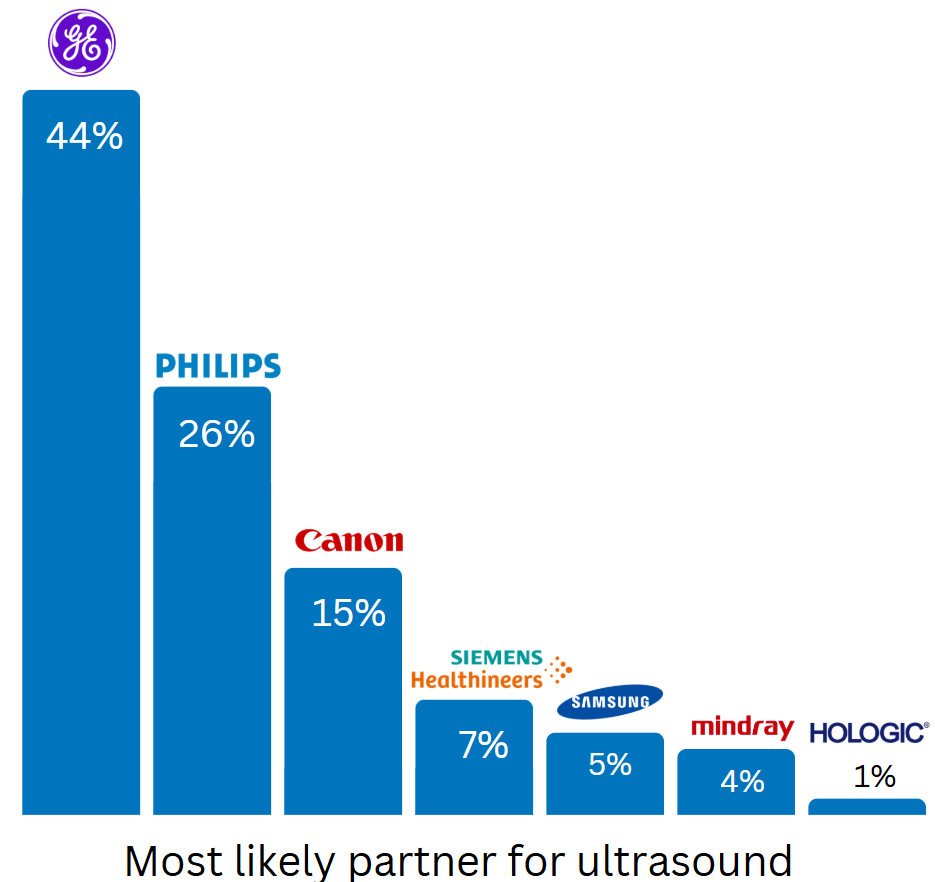

In ultrasound, the “most likely partner for 2025” order exactly reflects the “best vendor for ultrasound equipment” but with a larger difference between GE Healthcare and Philips (44% and 26% respectively, compared to 40% and 32% for best vendor), which may indicate a better commercial performance of GE Healthcare on the US territory.

Most Innovative Vendor

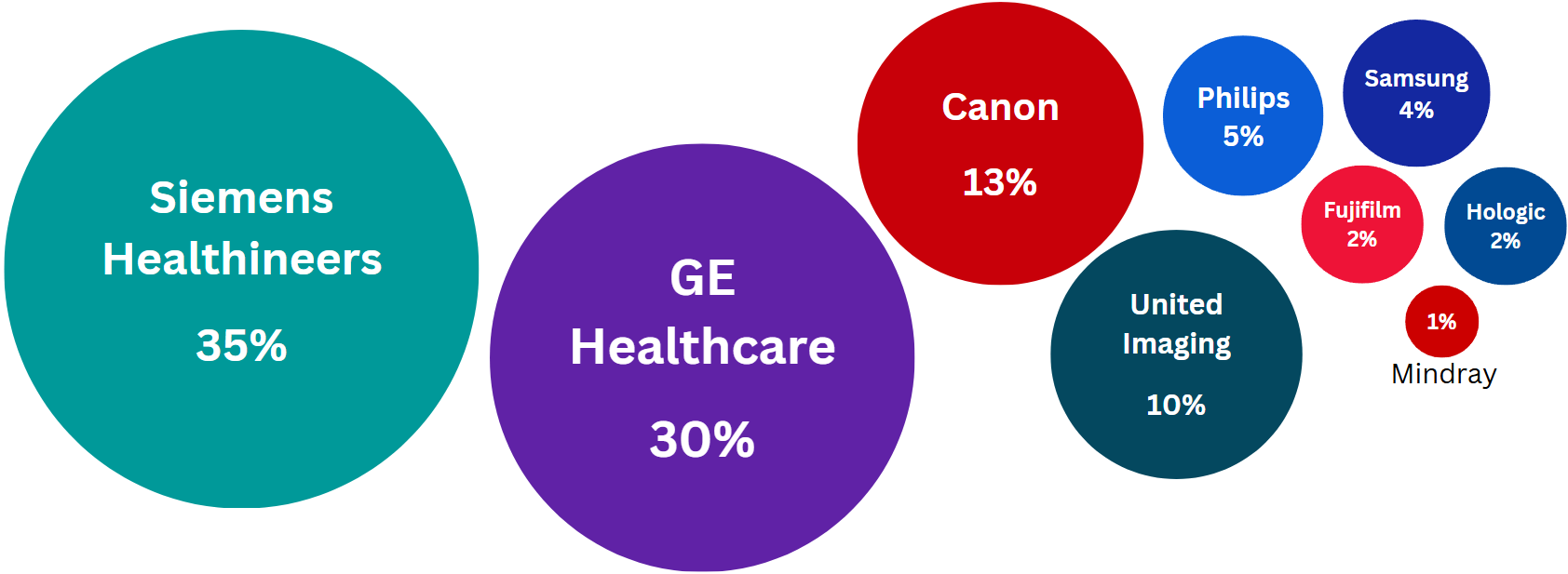

The most innovative vendors are Siemens and GE Healthcare, selected by 35% and 30% of imagePRO members respectively. Canon is third with 13%. This top 3 corresponds to the top vendors in large equipment (MR and CT), and may indicate that perception of innovation is mostly linked to the large modalities. United Imaging in fourth with 10% selection reinforces this hypothesis since the company only focuses on large medical imaging equipment.

Do not hesitate to contact us for deeper analysis on this first series of iPMP – the imagePRO panel can be segmented by hospital type, current install base, and many other demographic information!